Still waiting on confirmation — very close to getting our answer

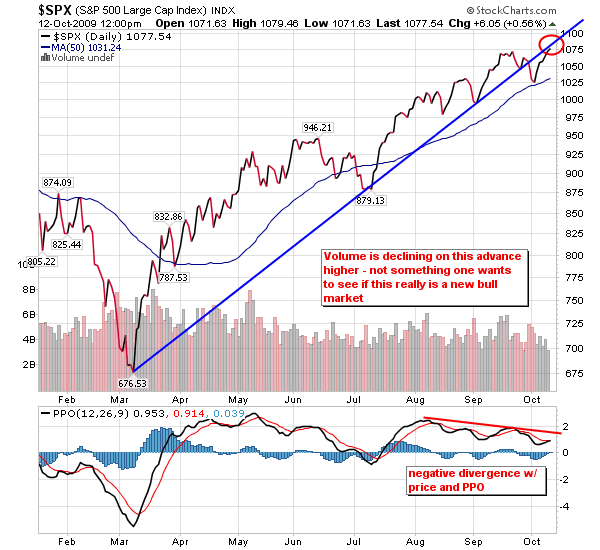

The SPX did end up breaking the uptrend line from the March lows on a log chart. It is still holding on a linear chart. Disclaimer, I give more credence to log charts as they show a percentage move more adequately than a linear chart. So on a log chart the SPX broke the uptrend line, bounced off the 50 dma, and now we are retesting the broken uptrend line.

This is an ideal area to scale into shorts with a stop above the uptrend line. Failing to get back above the broken uptrend line tells us the momentum is starting to be lost, and declining volume is another red flag providing confirmation that a correction has begun. However, getting back above this uptrend line and clearing 1090 can give us a run to 1120, and clearing that can give us a very quick spike to 1200. So as always, risk management is crucial especially at potential turning points.

Remember, and let’s not kid ourselves, we are trying to pick a top here — something that only the best traders can pull off successfully very few times in their careers. Even then, there will be a few tiny losses when the top turns out to not be the top. Playing this without risk management in place is never advisable, and will result in losses even if not in this particular instance. Sometimes that is the worst thing that can happen to a trader — the market rewards a trader for taking foolish risk without any management in place, the trader becomes complacent and throws caution to the wind only to get whacked later with a much bigger loss. Never abandon risk management, no matter what the technicals or even fundamentals say.